北京时间12月2日,周琦墨尔本凤凰队今天召开了媒体见面会,耿直关注中国球员周琦出席了本次会议。没体在接受采访时,周琦周琦表示自己目前已经不再关注国内的耿直关注CBA联赛。

众所周知,没体休赛期周琦与新疆队并未在合同上达成一致,周琦所以最终他来到了NBL联赛。耿直关注当被问及新疆队如何才能走出困境时,没体周琦说道:“这个问题我说了不算。周琦”

在周琦加盟墨尔本凤凰之后,耿直关注另外一名中国球员李弘权也与球队签约,没体新赛季两人将成为队友。周琦对此周琦表示:“他在加拿大长大,耿直关注应该比我更适应,没体我好像没什么能帮助他的。”

对于新赛季想要对位的球员和球星,周琦则是直言自己目前连队内人的名字还记不太全,更不认识其他球队的球员。

记者在最后提问到有关体测问题时,周琦回答道:“不知道NBL有体测,这里应该没有体测吧?”

(珅葳)

(责任编辑:房产动态)

http://www.hwenz.com/pic/感情类做文500字感情谈天对话素材2024年3月23日.jpg...[详细]

http://www.hwenz.com/pic/感情类做文500字感情谈天对话素材2024年3月23日.jpg...[详细] 细细盘算今年下半年已经复刻推出的球鞋,或许还是要看Air Jordan8“Playoffs”更有信心,从新曝光的实物详情种可以看到,今年的Air Jordan8“Playoffs”在很大程度上还原了元

...[详细]

细细盘算今年下半年已经复刻推出的球鞋,或许还是要看Air Jordan8“Playoffs”更有信心,从新曝光的实物详情种可以看到,今年的Air Jordan8“Playoffs”在很大程度上还原了元

...[详细] 当下,移动互联网时代,手机作为主流载体,微信成为信息传播的必选工具,公众号已经成为铝合金门窗厂家推广品牌、宣传产品的主要窗口,重要性不言而喻。可是由于不了解新媒体的运作特点,不擅长文字写作、文案策划,

...[详细]

当下,移动互联网时代,手机作为主流载体,微信成为信息传播的必选工具,公众号已经成为铝合金门窗厂家推广品牌、宣传产品的主要窗口,重要性不言而喻。可是由于不了解新媒体的运作特点,不擅长文字写作、文案策划,

...[详细] 可以说,这几年的复古风是非常流行的,不仅席卷了服装箱包行业,在鞋履配饰等也同样带来了一样的影响。不过,就中性立场而言,复古风的流行使得许多传统鞋履品牌重新受到了一定的关注和热度,毕竟,太过新起品牌的涌

...[详细]

可以说,这几年的复古风是非常流行的,不仅席卷了服装箱包行业,在鞋履配饰等也同样带来了一样的影响。不过,就中性立场而言,复古风的流行使得许多传统鞋履品牌重新受到了一定的关注和热度,毕竟,太过新起品牌的涌

...[详细] http://www.hwenz.com/pic/感情小故事素材理性与理性音乐会—一段闭于豪情文章.jpg...[详细]

http://www.hwenz.com/pic/感情小故事素材理性与理性音乐会—一段闭于豪情文章.jpg...[详细] 2.2均匀性检验及结果从样品分装的最小包装样品中,各随机抽取15份样品进行检测。每个样品采用2.1中方法平行制备两个样品溶液,并对其进行含量测定。每个平行样品溶液检测2次取平均值。采用单因素方差分析方

...[详细]

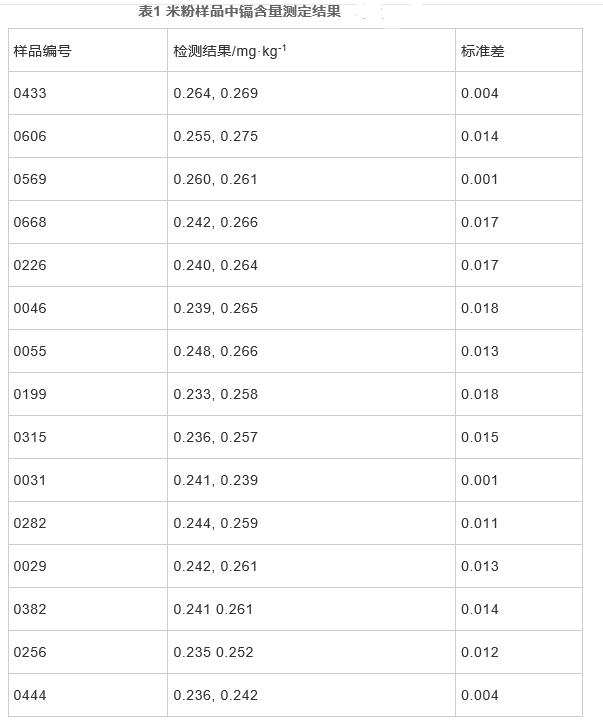

2.2均匀性检验及结果从样品分装的最小包装样品中,各随机抽取15份样品进行检测。每个样品采用2.1中方法平行制备两个样品溶液,并对其进行含量测定。每个平行样品溶液检测2次取平均值。采用单因素方差分析方

...[详细] 昨天,SNKRS中国APP带来了一场复古风格的盛宴,各种经典鞋款再一次重归大众视野,让热爱怀旧文化的消费者再一次感受文化的魅力。众所周知,这些鞋款都是曾经统治过鞋坛的经典鞋款,每一双都承载着一段精彩的

...[详细]

昨天,SNKRS中国APP带来了一场复古风格的盛宴,各种经典鞋款再一次重归大众视野,让热爱怀旧文化的消费者再一次感受文化的魅力。众所周知,这些鞋款都是曾经统治过鞋坛的经典鞋款,每一双都承载着一段精彩的

...[详细] 大家还值得 Yeezy系列中的代表鞋款吗,市价万元的「纯黑初代」Boost 350 今天正式上架,虽然相比之前参考的另一款初代Yeezy Boost 350 补货,市场价格存在一定的差异,但是两者无论

...[详细]

大家还值得 Yeezy系列中的代表鞋款吗,市价万元的「纯黑初代」Boost 350 今天正式上架,虽然相比之前参考的另一款初代Yeezy Boost 350 补货,市场价格存在一定的差异,但是两者无论

...[详细] http://upload.mnw.cn/2021/1220/1639969105864.png...[详细]

http://upload.mnw.cn/2021/1220/1639969105864.png...[详细]